To expand the tax base, the Pakistani government is adopting further steps. Filing tax returns is a different process from paying taxes. The Federal Board of Revenue (FBR) desires that all taxpayers file taxes. We will walk you through each step of how to pay taxes in Pakistan in 2019 in this helpful blog.

WHO CAN SUBMIT AN ONLINE REGISTRATION APPLICATION?

- Via an electronic filing system, only a person may register. As a result, associations of people and businesses must go through a slightly longer process.

- Only income tax returns may be filed electronically; sales tax filings are not eligible.

TAX FILING REQUIREMENTS IN PAKISTAN

- Copy of CNIC

- Registered mobile phone

- Actual salary earned throughout the most recent fiscal year

- The most recent fiscal year’s bank statement

- Bank statements and certifications that detail your tax deductions.

- Comprehensive information on the assets you had as of June 30, 2018, including share values, property values, and so forth.

HOW TO APPLY ONLINE TO BECOME A TAX FILER IN PAKISTAN?

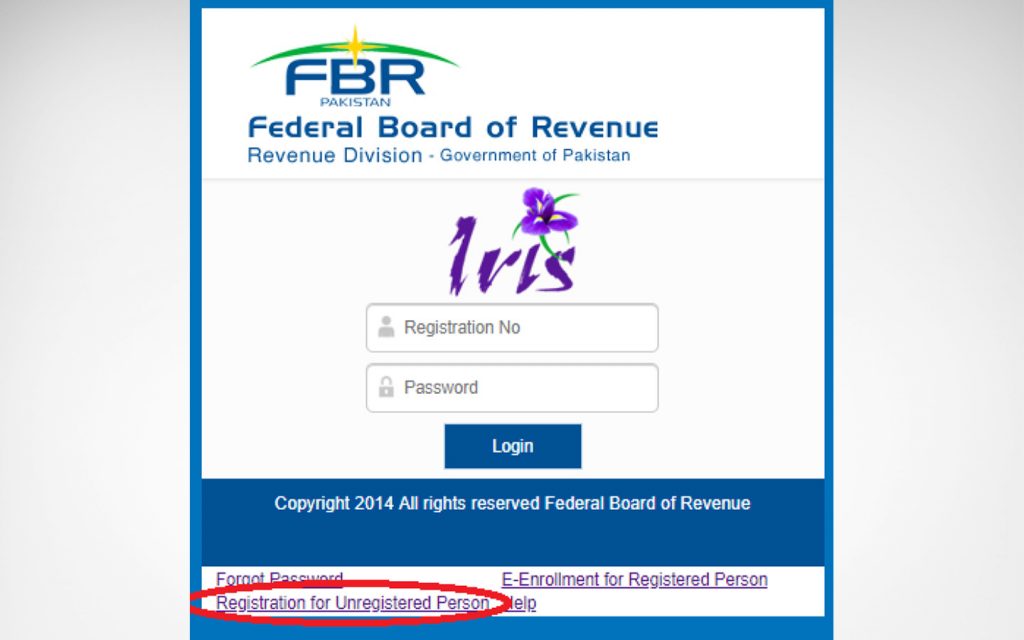

If you are filing taxes for the first time in Pakistan and have not yet registered, you must first do so by selecting the “Registration for Unregistered Person” button, which is circled in the image below.

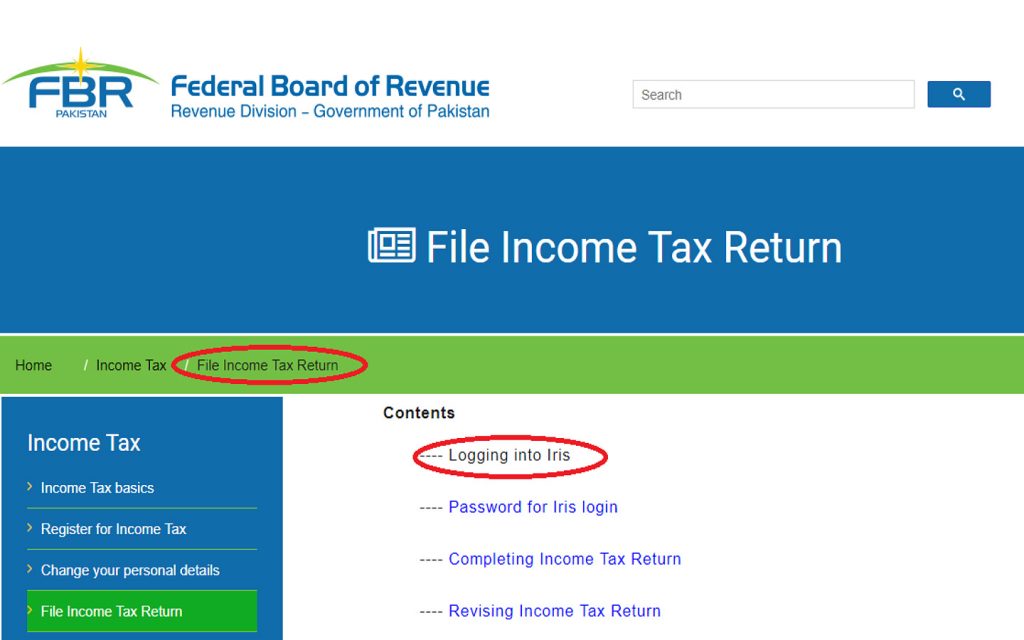

The query is, “How do I submit taxes?” There is a procedure for FBR to register tax filers online. Open the “file income tax returns” option on the official FBR website if you already have a National Tax Number, or NTN. Next choose Iris logging as seen in the image below.

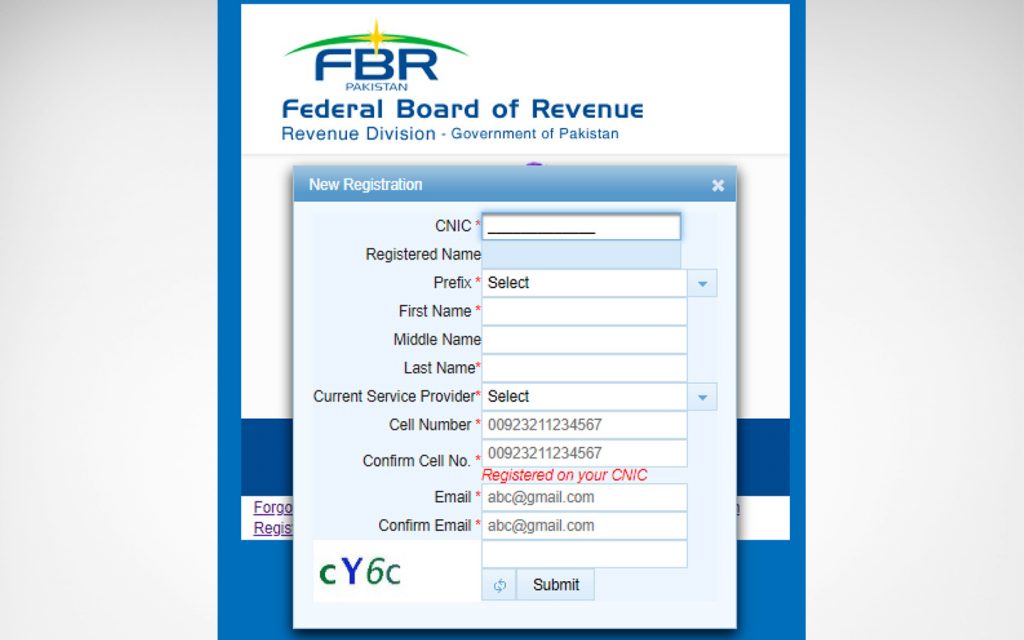

Your phone number and email address will be confirmed when you click “submit” and provide all the necessary information via different codes delivered to your phone and email.

You will receive a text message with your registration number, which is identical to the CNIC number, along with a password and pin code after your phone number and email address have been validated. You may now use your registration/CNIC number and password to access your Iris account. Keep the pin code since you will want it once more to submit your wealth statement and income tax returns. Individuals without Iris login credentials who have a National Tax Number (NTN) or Registration Number can gain access by clicking on “E-enrollment for Registered Person.” We will go into great depth on the process of submitting tax returns in our upcoming blog.For those who are salaried, you will need to present a bank statement and the amount of taxes deducted. Any information pertaining to your earnings from the prior year, as well as, if you own property, the earnings from that property.

HOW DO YOU KNOW IF YOU FILE TAXES?

The Active Taxpayers List was previously updated on the fifteenth day of each month. Nonetheless, taxpayers experienced a lot of issues since they were unsure of whether they had filed or not. As a result, the Active Taxpayers List is now updated once a week. Every Sunday at noon, the ATL is updated. It is also posted by Monday. Banks, government agencies, and other agents categorize taxpayers as “filers” or “non-filers” in their database on a weekly basis. Did you find our guide on filing taxes to be useful? You can also take a look at the benefits of a tax filer against a non-filer.

Add a comment