Zakat is one of Islam’s five pillars and must be paid once every Islamic year (also known as the lunar year). This implies that you must set aside one date each year to compute your Zakat in relation to all of your assets accumulated during the year. Many Muslims regard the beginning of Ramadan as the time to calculate and pay Zakat.

To calculate your Zakat, you must first decide if you are a Sahib-e-Nisab. In other words, Zakat is only required of Muslims who have more than a certain amount of money and possessions. You can compute Zakat after determining if you are entitled to pay it.

CAN I PAY ZAKAT ACCORDING TO THE NISAB?

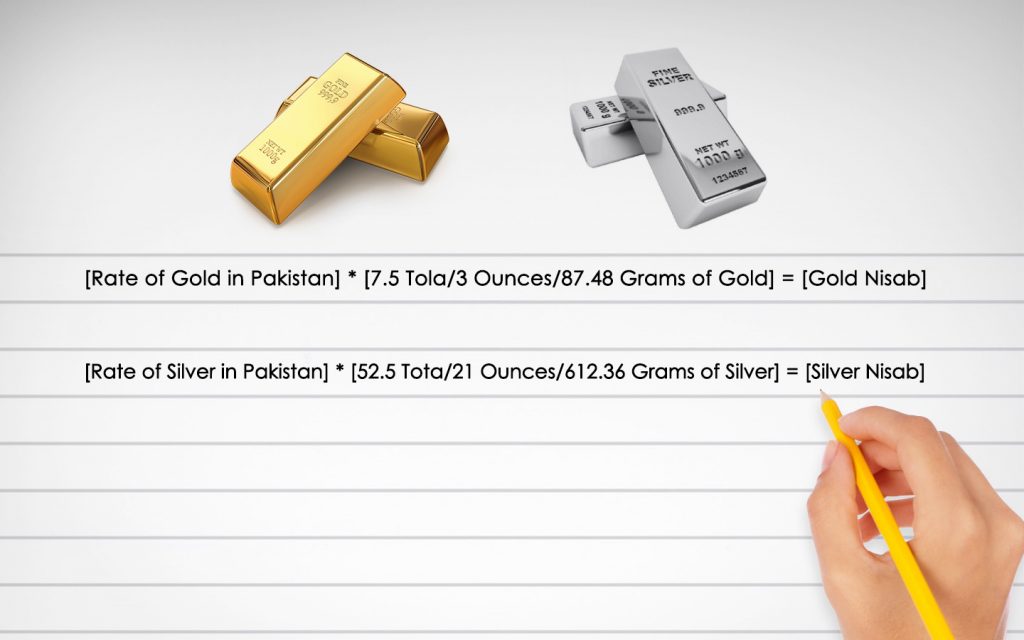

If the entire worth of your assets for a whole lunar year exceeds 7.5 tola/3 ounces/87.48 grams of gold or 52.5 tola/21 ounces/612.36 grams of silver, you are Sahib-e-Nisab and able to pay Zakat. Because gold and silver are no longer utilized as money, it is critical to convert the Nisab into your local currency using the current rate of either gold or silver on the day of computation.

Please keep in mind that while we’ll be using Pakistani Rupees (PKR) as the default currency in our examples to demonstrate how to calculate Zakat in Pakistan, all of the rates and currency values will vary depending on when and where you calculate your Zakat.

Assume you’re calculating your zakat on a day when gold is worth PKR 133,300 per tola in Pakistan. Thus:

PKR 133,300 multiplied by 7.5 tola equals PKR 999,750. [Nine lakh, nine lakh, nine hundred and fifty rupees]

Nevertheless, if you use silver to compute the Nisab and assume that the silver rate in Pakistan on that day is PKR 1,749 a tola, the total would be:

PKR 1,749 multiplied by 52.5 tolas yields PKR 91,823 (ninety one thousand, eight hundred and twenty three rupees).

EXPLANATION

This implies that if you calculate your Zakat using the gold Nisab and have more than PKR 999,750 in savings and assets for a complete lunar year, you are entitled to pay Zakat on them. Meanwhile, you must pay Zakat on assets and funds held for a complete lunar year if they exceed PKR 91,823 based on the silver Nisab.

The crucial thing to remember here is that your net worth must be more than the Nisab for the entire lunar year. If your assets fall below PKR 91,823 (for example) during the lunar year, your lunar year will resume when you are back over the Nisab, and the resuming date on the Islamic calendar should basically be the day for calculating Zakat after a year. In contrast, if you are Sahib-e-Nisab all year, you can select any day of the year to assess your wealth, although as previously said, many individuals choose the month of Ramadan for this generous gesture.

You may see the most recent gold rate in Pakistan here.

SHOULD YOU GET A GOLD OR A SILVER NISAB?

The issue now is, which Nisab should you select? While the silver Nisab is more rewarding for both the giver and the recipient, since more Zakat is given owing to the lower threshold, there is a technique to identify which Nisab to utilize.

In general, if you simply have gold assets and money, that is the Nisab you should employ. But, if you have savings and assets in silver or a mix of assets such as cash, gold, silver, and other marketable commodities, the silver Nisab is suitable.

Please keep in mind that various religious groups may have different viewpoints on which Nisab you should follow, therefore if in doubt, consult an Aalim-e-Deen.

ZAKAT CALCULATING FOR 2023

So you computed your Nisab and discovered that you are qualified to pay Zakat in 2023. While there are a lot of Zakat calculators available online, the most of them will not show you how they computed Zakat for a certain year. In contrast, we’ll walk you through a step-by-step approach to teach you how to calculate Zakat on gold and all of your other assets for one lunar year.

To begin, keep in mind that Zakat applies to savings and assets that exceed your personal belongings. As a result, your home, clothing, automobile, appliances, and other everyday necessities are not included in Zakat calculations.

MUST BE INCLUDED ASSETS

You must examine the following savings or assets:

- Money, whether at home or at the bank

- You own foreign currency (valued at the conversion rate of the local currency)

- Funds laid aside for a certain purpose, such as Hajj, marriage, or purchasing a car.

- The worth of all of your gold and silver in your local currency.

- The market worth of any shares you may hold if you choose to sell them.

- If you do not intend to sell your shares in the near future, you will get the dividend.

- Money owing to you and due to be returned in the near future

- Company owners should also reflect the value of their stocks on their balance sheet.

- Rental property owners should also keep track of any stored rental revenue.

- If a property is purchased as an investment to be sold, its market worth must be considered.

- Profit expected from the sale of an investment asset in the near future

The following liabilities should not be included while calculating Zakat:

- The total amount of outstanding utilities and credit card bills

- Whatever outstanding rent you owe to your landlord

- The amount owed on any personal loans or mortgages that you have taken out.

- The worth of a property that you have rented to a renter.

- Any money owed to your staff as a pay

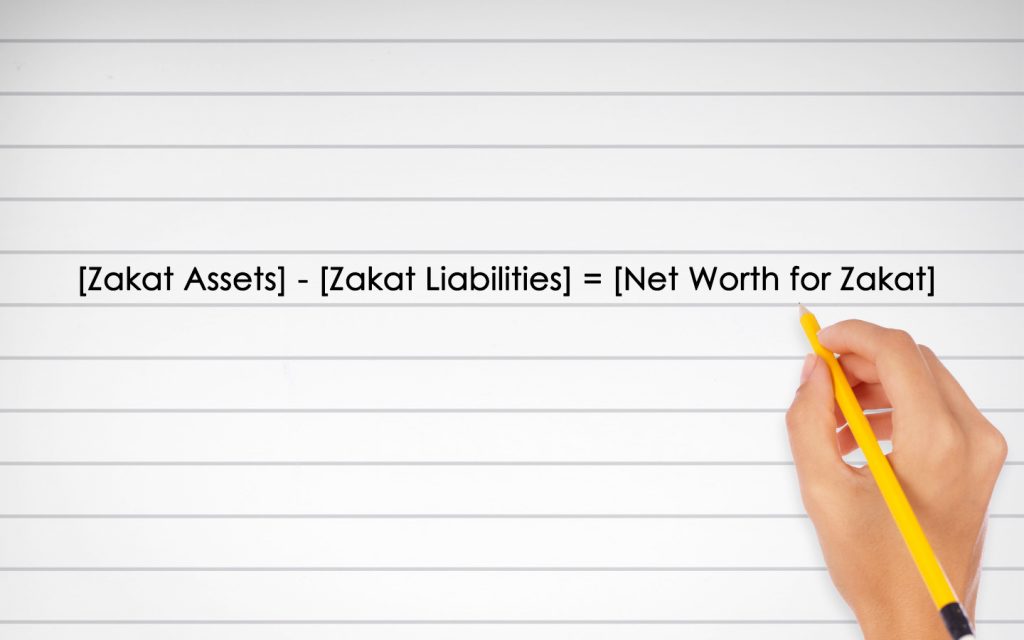

CALCULATION EXAMPLE FOR ASSETS AND LIABILITIES

Using the above asset and liability criteria, say you have PKR 300,000 in cash, PKR 350,000 in gold and silver jewelry, and PKR 250,000 in foreign currency (value converted into Pakistani rupees at the market rate, on the day of Zakat calculation).

As a result, you have:

[Total Assets for a Whole Lunar Year] PKR 300,000 + PKR 350,000 + PKR 250,000 = PKR 900,000

After calculating your assets, you may compute the total value of your obligations. If you owe PKR 12,000 in delayed energy bills and PKR 38,000 in unpaid rent to your landlord, your total obligations would be:

38,000 PKR + 12,000 PKR = 50,000 PKR [Immediate Liabilities to Subtract From Total Assets]

As a result, your net Zakat worth is:

PKR 900,000 minus PKR 50,000 equals PKR 850,000. [Zakat Net Worth]

Because of the presence of mixed assets, we will evaluate the silver Nisab, which qualifies you for Zakat.

THE ZAKAT RATE

The relevant Zakat rate is 2.5% or the 40th fraction of your total wealth for one lunar year. As a result, we will double the net value we just determined by this rate:

PKR 850,000 * 2.5% = PKR 21,250 [This Year’s Zakat]

You may also multiply the computed net value by 0.025. Both methods will provide the same results:

PKR 850,000 * 0.025 = PKR 21,250 [This Year’s Zakat]

A third option is to divide the computed net worth of assets by 40, as Zakat applies to the 40th percentile of our wealth.

PKR 850,000/40 = PKR 21,250 [This Year’s Zakat]

It is critical to note that the rate of Zakat is the bare minimum of Zakat that every Sahib-e-Nisab Muslim is required to pay. There is no maximum barrier, and you can give more Zakat on gold and other valuables than is required if you want to support poor Muslims in your community.

ZAKAT WILL BE DISTRIBUTED IN WHAT MANNER?

Now that you know how to calculate your Zakat, let’s talk about how it’s distributed:

The computed Zakat amount can be paid in one single transaction, or it can be paid in instalments throughout the year until the following lunar year begins. Zakat, on the other hand, may only be paid to those who fall into one of the eight categories stated in the Quran.

MASARIF-E-ZAKAT (RECIPIENTS OF ZAKAT)

The Quran identifies the following eight types of persons as eligible Zakat recipients:

- Fuqaraa [poor and low-income people]

- Masakeen [needy Muslims who lack even the most basic necessities]

- Aamileen [officials designated by an Islamic State to collect Zakat]

- Muallafat-ul-Quloob [new underprivileged Muslims inclining their hearts even more towards Islam]

- Ar-Riqaab [slaves and captives freed from their owners]

- Al-Gharimeen [debtors among Muslims]

- Fi Sabeelillah [needy Muslims away from home performing good works like as Hajj or Jihaad]

- Ibn-us-Sabeel [a traveling companion who is in need for the duration of the voyage]

EXCEPTIONS TO THE FOREGOING

Zakat can only be paid to people who fit into one of the eight categories indicated above, but there are certain things to bear in mind. To begin, Zakat must be provided to someone who can become the owner of the amount. It is critical that the receiver has the Zakat on hand. As a result, it cannot be given to an organization that does not offer the needy complete ownership of Zakat.

Similarly, it cannot be used to pay for a deceased person’s funeral or to settle their debts because they are no longer the legal owner of the money. It also cannot be used to purchase materials or property for an organization or the public good.

Additionally, Zakat cannot be given to:

- The rich

- Non-Muslims

- The family of the Prophet (Peace Be Upon Him)

- Your direct dependents [including your wife, parents, grandparents, children, and grandchildren]

During the Coronavirus lockdown this year, many of our hired workers and other needy individuals have been unable to stock up on food and other household goods. While you can just aid them out of the kindness of your heart, you can also utilize Zakat to help them stock their houses in these difficult times so that they can stay at home and be secure with their families.

THE ZAKAT DEDUCTION CONCEPT AT SOURCE

Zakat not only helps us cleanse our monetary possessions, but it is also a way for society to support the poor and needy. Using the principles described above, calculate your Zakat for 2023 and locate its proper owner within your community.

When you’re doing the math, keep in mind that Pakistan is one of the Muslim nations where Zakat is required and collected by the state through savings and profit-and-loss accounts. On the first of Ramadan, all banks across the country undertake this procedure known as Zakat deduction at source.

As a result, if you are not exempt from Zakat and have more than the Nisab (based on the silver rate) established by the State Bank of Pakistan for a given year, Zakat will be taken at a rate of 2.5% of your account balance. The Zakat collected is subsequently transferred to the Bait-ul-Maal, which is maintained by the Government of Pakistan to assist the needy and underprivileged. In such cases, you do not required to calculate and pay your Zakat on your savings account.

FAQS ON ZAKAT

Here’s a quick summary of the post, concentrating on some of the most often asked issues about Zakat, its computation, and eligibility:

IS IT POSSIBLE FOR ME TO PAY ZAKAT?

Only if you happen to be Sahib-e-Nisab.

WHERE CAN I FIND OUT IF I ARE SAHIB-E-NISAB?

You are considered Sahib-e-Nisab and must pay Zakat if you hold 7.5 tola/3 ounces/87.48 grams of gold or 52.5 tola/21 ounces/612.36 grams of silver or its monetary equivalent for a complete lunar year.

IS THE CURRENT RATE OF GOLD OR SILVER IN YOUR LOCAL CURRENCY REQUIRED?

Absolutely, because the majority of your assets will be in your home currency, you must convert them all into the same currency for simplicity of computation. This implies that in order to calculate Zakat in Pakistan, all assets must be converted into Pakistani rupees (PKR).

HOW DO I DETERMINE THE RATE OF GOLD OR SILVER IN PAKISTAN ON ANY GIVEN DAY?

You can simply get the current gold or silver price in Pakistan online.

WHICH NISAB SHOULD I GET?

- Gold – If your only assets and savings are in gold.

- Silver – If you have silver savings and assets or a combination of assets such as cash, gold, silver, and other marketable commodities.

IS ZAKAT VALID ON FUTURE ASSETS?

Yes, but only if:

- You purchased an asset as an investment with the idea of selling it later.

- You have definitive confirmation of the sale of an asset but do not yet have the funds.

IS ZAKAT PAYABLE ON PERSONAL USE ITEMS?

No, Zakat must be paid on all assets other than personal use items. This means that if you possess two houses or two automobiles but only use one of them on a daily basis, Zakat is only applicable to the one that is not in use.

I HAD SAVED SOME MONEY FOR HAJJ. ARE THEY NEED TO BE INCLUDED IN MY ASSETS?

Indeed, all funds must be included in your overall assets, even those set aside for religious pilgrimages.

ARE ZAKAT’S FUTURE LIABILITIES EXCLUDED?

No, only outstanding liabilities, such as invoices and other costs that must be paid but have not yet been paid, are exempt from Zakat. This implies you can’t deduct next month’s rent from your net worth, even if you’re calculating your Zakat in the last days of the month.

CAN I PURCHASE ZAKAT FOR MORE THAN 2.5% OF MY NET WORTH?

Absolutely, the minimum amount of Zakat that every Sahib-e-Nisab Muslim is required to pay is 2.5%. Yet, there is no upper limit.

IS IT POSSIBLE TO PAY ZAKAT IN INSTALLMENTS?

Yes, you can pay Zakat in monthly installments throughout the year. You must, however, pay it in full before the new lunar year begins.

CAN ZAKAT ONLY BE GIVEN TO ONE RECIPIENT?

Sure, if you know of someone who needs the entire amount, you can opt to gift it to only one person.

CAN I GIVE ZAKAT TO MY FAMILY AND RELATIVES?

Giving Zakat to your closest family and neighbors is regarded Afzal or more gratifying. You cannot, however, pay Zakat to your directly dependent relatives or those on whom you are obligated to spend, such as:

- Wife

- Children

- Grandchildren

- Parents

- Grandparents

CAN I GIVE ZAKAT TO NON-DEPENDENT FAMILY MEMBERS?

Yes, it is considered ideal to do so. Non-dependent family members can include:

- Brother

- Sister

- Brother’s son or daughter (Bhatija or Bhatiji)

- Sister’s son or daughter (Bhaanja or Bhaanji)

- Paternal aunt or uncle (Chacha or Phuphoo)

- Maternal aunt or uncle (Mamu or Khala)

- Mother-in-law or father-in-law (Saas or Susar)

- Son-in-law or daughter-in-law (Damad or Bahu)

CAN A WIFE GIVE ZAKAT TO HER HUSBAND IN NEED?

Absolutely, but only if her spouse falls into one of the eight categories. Moreover, Zakat money cannot be used to support the home or be spent on costs for the husband’s wife. He can put the Zakat money toward debt repayment and personal costs.

MY WIFE’S NAME IS SAHIB-E-NISAB, BUT I AM NOT. DO I OWES ZAKAT ON HER ASSETS?

No, every Muslim is responsible for paying Zakat on his or her own possessions. The husband is not required to pay Zakat on his wife’s possessions, although he may do so if he so desires. The woman must compute her own Zakat and pay it from her annual net worth.

IS ZAKAT APPLICABLE TO CHILDREN OR MINORS’ ASSETS?

No, Zakat does not apply to children, nor is their guardian obligated to pay Zakat on their assets, even if they are Sahib-e-Nisab. Zakat is applicable to all Muslims after puberty, with one lunar year finished a year after puberty if the kid is already Sahib-e-Nisab. Nevertheless, various sects have varied perspectives on this issue, thus it is advisable to seek clarification from an Aalim-e-Deen.

IS ZAKAT APPLICABLE TO A MENTALLY ILL OR UNSTABLE PERSON’S WEALTH?

No, Zakat does not apply to any riches possessed by mentally ill people since they are unable to accept responsibility for their wealth and distribute it appropriately. But, depending on your unique circumstances, it is always better to contact a religious scholar.

I WANT TO CALCULATE AND DISTRIBUTE THE ZAKAT ON MY OWN SAVINGS ACCOUNT. IS THERE A WAY FOR ME TO INFORM MY BANK?

Many Muslims prefer to give Zakat to those in need whom they know personally. If this is the case, you can submit a Zakat Declaration Form to the branch where you hold your savings account before Sha’ban 15th.

Add a comment