The Pakistani government has unveiled a fresh program to support outstanding young people in following their new growth avenues. The Youth Business and Agricultural Credit Schemes were just introduced by Prime Minister Shahbaz Sharif to encourage young self-employment and the development of jobs as a standard.

Those between the ages of 21 and 45 may apply for a loan of up to 75 lakh under the PM’s Youth Loan Scheme. Nevertheless, the minimum age requirement is 18 for people with an interest in the IT and e-commerce industries.

“The loan up to PKR 0.5 million will not have an interest rate. The loan amount beyond PKR 0.5 million to 1.5 million would be subject to a 5% interest rate, the prime minister announced at the inauguration event in Islamabad. “The loan amount over PKR 1.5 million and up to PKR 7.5 million would be subject to a 7% interest rate.”

Moreover, the credit facility will assist in introducing and promoting the use of cutting-edge technologies in agriculture among young people in rural regions. Businesses might become more sustainable, ecologically friendly, safe, and, of course, lucrative as a result of innovation in this area.

CRITERIA FOR ELIGIBILITY IN PAKISTAN'S PM'S YOUTH LOAN PROGRAM

Applicants for the prime minister’s youth loan program must be Pakistani citizens who fit within the aforementioned age range. Also, those who work for the bank chosen for the loan application as well as those who are politically exposed are ineligible for this project.

It is also crucial to note that submitting the application does not need supplying a National Tax Number (NTN). Nonetheless, holding an NTN might improve your chances of selection, according the scheme’s official website.

For further details, feel free to read our guide on how to submit taxes in Pakistan.

WHAT IS NECESSARY TO APPLY FOR THE LOAN PLAN?

The documents listed below are required to complete your application.

- Passport-sized photograph

- CNIC scanned copy (both sides)

- Most recent academic degree or certificate (Matric, Intermediate, Bachelor, Master, PhD etc.)

- Certificates of experience, if any

- If applicable, a license or registration with a chamber or trade body

- A letter of reference from the relevant chamber, trade association, or union in the case of an established firm

- Financial records

- Business strategy

- Bank statements over the last six months

Also, you should have this information on hand:

- National Tax ID

- The consumer identification number on your most recent utility bill

- If there is one, it may be found on your current office address’ electrical bill.

- Every car that is registered in your name with a registration number

- Two references’ names, CNICs, and cellphone numbers (other than blood relatives)

- Specifics of your household’s, your business’s, and other expenses each month

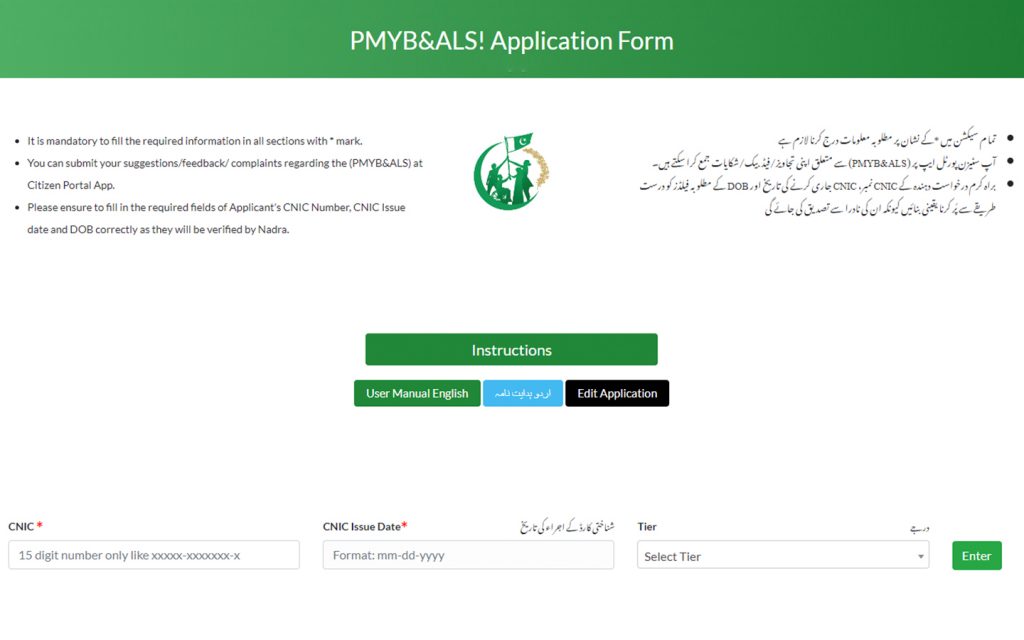

FOR PM'S YOUTH LOAN SCHEME: APPLICATION INSTRUCTIONS

Here is a step-by-step guide on how to apply for Pakistan’s new program for young businesses.

- Click here to see the registration page. If it doesn’t work, please put (https://pmyp.gov.pk/bankform/newapplicantform) into the browser.

- To avoid confusion, click the ‘Instructions’ button and carefully read each tip.

- Enter your CNIC number, the CNIC issuing date, and choose a tier:

- Tier 1: A loan up to PKR 5 lakh with 0% interest.

- Tier 2: A loan up to PKR 15 lakh with a 5% markup.

- Tier 3: A loan up to PKR 75 lakh with a 7% markup

- To be sent to the application form, click enter.

- There are several parts on the form. Fill in the necessary fields in Section A: Initial Selection starting at the top of your abilities. Please take note that all required fields are indicated with an asterisk (*).

- Provide the information about your selected references in the appropriate fields once you have completed all nine parts. Their names, your relationship to them, their CNIC numbers, and their mobile numbers are among these facts.

- A Declaration Form is located at the bottom of the form. Before signing the last part, please double-check your application.

Please be aware that NADRA will verify all of the data you’ve provided. A modification or update cannot be made to the form after it has been submitted. Also, users have the option to submit the form all at once or save their work at any moment. But, if you have all of your paperwork ready, registration should just take a half-hour or less.

This concludes our blog post on the Youth Business and Agricultural Loan Programmes application process.

Add a comment